The Morning Line

The Wizards Cannot Hold Down the Dollar

For more than a year, I’ve recommended what my friend Doug Behnfield calls the ‘barbell strategy’ to secure one’s nest egg against the deflationary hard times that lie ahead. As formulated by Doug, a wealth-management advisor based in Boulder, the barbell portfolio is constructed with gold and bonds as offsets. Try to imagine the worst of times and you may have difficulty concocting a scenario in which T-Bonds and munis on one hand, and gold on the other, would fall together. However, it is relatively easy to imagine circumstances in which either or even both sides of the hedge would rise in times of extreme economic adversity.

For more than a year, I’ve recommended what my friend Doug Behnfield calls the ‘barbell strategy’ to secure one’s nest egg against the deflationary hard times that lie ahead. As formulated by Doug, a wealth-management advisor based in Boulder, the barbell portfolio is constructed with gold and bonds as offsets. Try to imagine the worst of times and you may have difficulty concocting a scenario in which T-Bonds and munis on one hand, and gold on the other, would fall together. However, it is relatively easy to imagine circumstances in which either or even both sides of the hedge would rise in times of extreme economic adversity.

I had suggested holding off on the T-Bond portion of the hedge until interest rates peak. That day is coming, probably sooner than most ‘experts’ think, but we are not quite there yet. Yields on the Ten-Year Note ended last week at 2.71%, but my forecast calls for a top, or at least a lengthy leveling off, at exactly 3.24%. This is somewhat higher than the 3.02% rate I’d projected for the 30-Year T-Bond, the difference lying in the way their respective rallies have unfolded. For purposes of optimizing the barbell hedge, however, I’d suggest using the 3.24% rate indicated in the chart above.

No More Volckers

A top at that level would be a far cry from the 20% peak in June 1981 that followed two years of tightening by Paul Volcker. As a result, inflation remained subdued for more than 30 years. The effects of tightening this time around could not conceivably turn out to be as benign as before because the debt sums affected are exponentially larger. To cite one particularly menacing example, Third World debts amounted to perhaps $1.5 trillion in the mid-1980s. This sum was deemed sufficient to topple the global banking system if something were not done about it. In the end, nothing was done about it. The debts were simply papered over, providing a fresh foundation for untold heights of indebtedness that currently total more than $2 quadrillion. That number includes the notional value of the world’s chief instrumentality for borrowing — i.e., a financial-derivatives market that has supplanted trade in actual goods and services as the planet’s main line of business.

If you’re worried that Powell & Co. will keep raising rates higher and higher until inflation has been ‘tamed,’ the good news is that these charlatans will never get the chance. The bad news is that a bear market in stocks will intervene well before then, not only quelling inflation, but setting in motion a deflationary implosion that will cause even 2%-3% rates to asphyxiate all who have borrowed in dollars. The list implicitly includes virtually everyone on the short-dollar side of the derivatives market.

Oil Just a ‘Warm-Up’

The rise in oil prices is a warm-up for this catastrophe, since the world is having to pay for energy with increasingly valuable dollars. The wizards who have effortlessly inflated asset values across- the-board over the last two decades are about to discover they are powerless to contain a deflation that will ultimately feed off a strengthening dollar and a corresponding increase in the real burden of debt. The size of the dollar market dwarfs even bonds, repos and swaps put together, a Frankenstein monster energized by lighting bolts that policy tinkering cannot divert.

Demographics Is Destiny In More Ways Than One

[Counting on the Fed to ride to the rescue when the bubble finally pops? You had better have a Plan B, and for good measure a Plan C, since America could be in for something far worse than mere recession when the asset boom ends. In the commentary below, my friend Charles Hugh-Smith spells out the reasons this is likely with greater clarity and concision than I have. I am grateful for his permission to reprint the essay, an installment of the ‘Musings’ emails that go out to subscribers every Saturday. Discover his extraordinary blog, books and deeply original reflections at OfTwoMinds.com by clicking here. RA ]

****

By Charles Hugh Smith

The saying “demographics is destiny” encapsulates the reality than demographics–rising or falling trends of births and deaths–boost or constrain economies and societies regardless of other conditions.

Demographics are long-term trends, but the trends can change relatively rapidly, with momentous future consequences.

As this article below mentions, extrapolating the high birth rates and falling death rates of the 1960s led to predictions of global famine.

As death rates declined and women’s educational and economics prospects brightened, birth rates fell, a trend that now encompasses most of the world.

As a result of the Green Revolution (hybrid seeds and hydrocarbon-based fertilizers), the Earth supports more than twice as many humans as were alive in the 1960s (3.5 billion then, 7.9 billion now).

Now the problem is a shrinking working-age population that will be unable to support the financial and healthcare promises made to the retired generations.

Birth rates in developed nations have fallen below replacement rates, which means populations are shrinking and

populations are aging rapidly, i.e. the average age of the populace is rising..

One side effect discussed in this article is the decline of the cohort of young males and the rise in the average age reduces the likelihood of conflict: Children of Men’ is really happening–Why Russia can’t afford to spare its young soldiers anymore.

I remember reading similar research in the mid-1970s that identified a strong correlation between the relative size of the cohort of young males and the likelihood of war.

If the cohort was above a specific percentage of the total population, war was likely. One example was Germany in the 1930, which had a large cohort of young males under the age of 25.

This may partially explain the increasing reliance on economic war (sanctions) and cyberwarfare–nations no longer have large enough cohorts of young males to field armies where high casualties are a reality.

(A longtime reader who has been in China traveling on business for months pointed out that due to the single-child policy–only recently lifted–Chinese families have only one son, and they are averse to that one son coming home in a body-bag as a casualty of a “war of choice” or indeed, any war.)

What the article mentions in passing–the demographic impact of social values and political power–is worth exploring.

In broad brush, several trends are visible in many nations and cultures.

One is that having children has gone from being an economic necessity or benefit to a tremendous financial liability in the developed world.

A Danish friend once commented that only wealthy families could afford to have three children now in Northern European countries. The same can be said of the U.S. and many other countries, once we consider the higher demands now placed on parents.

Where in the good old days of previous generations, parents were deemed adequate if they provided a roof over the kids’ heads, basic meals and clothing. Education was left up to the public schools, and public college was low-cost, should the child want to continue their education.

(The University of Hawaii tuition was $89 and student fees were $27, for a grand total of $117 per semester from 1971 to 1975, $780 in today’s dollars. I was able to support myself, pay all my university expenses and carry a full class load on a part-time job–in one of the two most expensive cities in the nation, Honolulu.)

In a fully globalized “winner take most” economy, parents with aspirations for a top 20% career and lifestyle for their children have a much more demanding burden.

Parents seeking to give their children a leg up must provide costly enrichment lessons and juggle complicated schedules of after-school classes. Prestigious universities now expect more than mere academic excellence; applicants must show evidence of leadership, civic engagement, etc., and even public universities are outrageously expensive.

Another trend is the cultural bias of favoring the elderly in terms of government support.

As workers increasingly lived long enough to actually retire, social and political values supported government funded pensions and healthcare for retirees.

In the high birth rates 1940, 50s and 60s, governments greatly increased benefits for the elderly / retired, as everyone assumed there would always be 4 or 5 workers for every retiree. Relatively few people lived to age 80 or older.

The steady decline in birth rates and the steady increase in longevity have dropped that ratio to less than 2 workers for every retiree. In the US, there are 127 million fulltime workers and 69 million Social Security beneficiaries (including disabled). That is less than 2 fulltime workers for every beneficiary.

In a recession, Boomers will continue retiring en masse while the workforce will shrink. A ratio of 1.5 workers to every beneficiary isn’t that far away.

Is there any doubt this ratio is unsustainable financially? No.

These two trends are a double-whammy on those young adults having children: the costs of raising kids is much higher, the expectations are much higher while the government support is heavily weighted to the elderly populace, which is exploding as people now live into their 80s and 90s. (My Mom is 93, my Mom-in-law who we care for here at home is 91, our neighbor’s Mom is 99, and so on.)

We have some elderly friends who retired from federal government jobs at age 55 after 30 years of service and have collected 40 years of retirement. Is this financially sustainable? No.

The actuarial foundations of Social Security and Medicare were based on 4 or 5 workers per beneficiary and average lifespans around 70. Retirees were expected to collect benefits for 5 to 7 years, not 25 to 30 years.

These systems are fundamentally unsustainable at current retirement ages (55 for many government workers, 62 for “early retirement” Social Security and 67 for full benefits and Medicare at 65), current longevity trends and less than 2 workers per retiree.

The only way to reverse these demographic trends would be for government support for retirees taking a back seat to government support of children and young parents, greatly reducing the financial burden of having children.

The only way an economy can support a massive population of elderly is if there are enough young workers entering the workforce to keep the society and economy functioning.

Forward-looking populations would realize supporting parents and children is the only way to support future retirees.

But humans aren’t very forwarding-looking; we want all the good stuff now. So the elderly support politicians who promise their benefits are sacrosanct and untouchable–except to increase them.

Almost all elderly people vote while a much lower percentage of young people vote. So the government continues supporting the elderly even as the population of elderly explodes and the means to provide this support are in free-fall.

Retirement ages have barely budged, increasing a mere two years in 40 years from 65 to 67, while lifespans have greatly advanced and the worker-retiree ratio has collapsed.

Open-ended healthcare expenses are an invitation for profiteering, fraud and unnecessary or even harmful medications and procedures. By some estimates, 40% of the $1.5 trillion dollars spent on Medicare and Medicaid annually is paper-shuffling, fraud and needless medications and procedures.

A third trend is female workers wanting a fulfilling career and children, too.

With childcare costing $25,000 or more annually, one parent may essentially be working just to pay the childcare costs for two children.

A fourth trend is relying on high birth rate immigrants to substitute for native-born workers is no longer viable, as birth rates have plummeted in nations that provide immigrants.

As the saying has it, something’s gotta give. Doing nothing will lead to the collapse of the programs benefiting the elderly while the birth rate continues declining.

All these values and programs assumed high birth rates, high worker-retiree ratios and modest costs for raising children were forever. They weren’t.

Now we need a new set of values that reduce or eliminate the financial burdens on parents raising children. It would be nice if we could afford to pay for everything we want but printing money to do so just collapses the entire system.

Personally, I would raise retirement ages to match the rise in lifespans, limit publicly funded extraordinary healthcare measures for people over the average lifespan, tax revenues rather than labor, and pay all childcare and after-school programs expenses currently paid by parents, plus a set sum per child that can only be spent on after-school enrichment classes and programs.

That seems common-sense to me, but I’m open to other permutations of hard choices.

Hard choices lead to better outcomes than collapse, but few have any stomach for hard choices. Politicians who make hard choices that require sacrifices of powerful lobbies and voting blocks lose elections.

The fantasy that we can “print our way out of any problem” is strong because it’s so convenient and apparently so successful–at first.

Whether we admit it or not, collapse is the default “solution.” That destiny has already written by demographics.

Another Setback for Permabears

Last week’s commentary was skeptical that the short squeeze begun two weeks ago in the broad averages would prove to be just a bear rally. Based on the latest technical evidence, it now seems likely that stocks are headed to new all-time highs. This is despite the fact that the world is going to hell in a handbasket, Biden’s wrecking-ball presidency has a thousand days to go, China and Russia have joined forces to hobble the U.S. however they can, and there is even talk that America could be in for its first-ever food shortage. This comes on top of soaring prices for gas, groceries and nearly everything else, as well as a looming earnings recession. Throw in Fed tightening to the horizon line and you have quite a list of things about which Wall Street evidently cares little if at all.

As always, we need look no further than Apple’s chart to understand exactly where the market is headed. AAPL is a perfect proxy for institutional mindset, a one-decision stock since 2009 that has made erstwhile chimpanzees look like geniuses. DaBoyz have hung together on AAPL for 13 years, selling almost none of it from their portfolios, and buying every dip. A 4-for-1 stock split back in August 2020 allowed the rubes and riff-raff to join in the fun — an opportunity to play AAPL stock and options with relatively small change. It became the biggest-cap stock in the world as a result and is likely to grow even fatter on perpetually spun news that, this time, it’s teaming up with Porsche to have yet another vague but promotable go at the car business.

Sunny and Mild: Ugh!

The chart shows that buyers shredded their way past a ‘midpoint Hidden Pivot’ at 167.80 last week. This all but clinched the subsequent 5% rally and minimum upside to the pink line, a ‘secondary’ pivot at 176.65. That is a place where bull moves can stall fatally, and the possibility cannot be ruled out. However, permabears shouldn’t get their hopes too high, since the impalement of p=167.80 was inversely akin to the groundhog seeing his shadow. He did, and it will likely spell at least six more weeks of sunny and mild weather to be endured by pessimists who think a correction worthy of the name is years overdue. If the move easily surpasses 176.50, you can count on more upside to at least 185.50, or even to 193.78. That would pull the stock market higher, postponing Papa Bear’s arrival yet again, as well as a day of reckoning for investors who long ago jettisoned the concept of value.

Just a Bear Rally?

With the supposed bear rally about to enter its fifth week, I am reminded of Gideon Drew, “the thing that wouldn’t die” in the 1958 horror movie of that name. Like Drew, the stock market has become a disembodied monster, able to command loyalty and teacherous obedience with just a creepy movement of the eye. The fictional Drew was beheaded for devil-worship by Sir Francis Drake, but the evil-thinking piece of him came back to life when the crate in which it was buried got dug up by some hapless D-list actors. They are akin to today’s investors, who for 13 years have been mesmerized by a stock-market bull that long ago decoupled from the corpus of reality. The bull will eventually send them over a cliff, as all bull markets inevitably do. But until that happens, the delusional herd will remain transfixed by the incantations of greedy Wall Street hucksters who can spin alluring dreams from even the scariest headlines.

Cocksure, Sort of…

And scary they are — so much so that the potentially world-shaking geopolitical disaster in Ukraine ranked only seventh on one well publicized list of Americans’ biggest concerns. With such a formidable catalogue of troubles, it seemed more than a little plausible that the powerful selloff of stocks that began on January 4 was the start of a bear market. That is still what many, including some of my most astute guru colleagues, seem to believe. We were pretty cocksure about this when the S&P 500 dove 600 points, or 12%, in the first three weeks of the year. When a powerful bear rally intervened in late January/early February, most of us stood our ground; and then we doubled down on costless certitude when stocks began to plummet anew at the end of February. Now they are thrusting sharply higher again, pushed by intense short-covering that reeks of stupidity. And yet, if the stupidity continues for just a few more days, stocks will reach a threshold at which bearish certitude — or at least mine — will begin to wither. Here’s a chart that shows the E-Mini S&Ps bound for at least 4584.25. If that Hidden Pivot is reached, the move would surpass two ‘external’ peaks, revitalizing the bullish energy of the chart. At that point new record-highs would become, if not certain, then at least likely. Caveat venditor! Let the short seller beware!

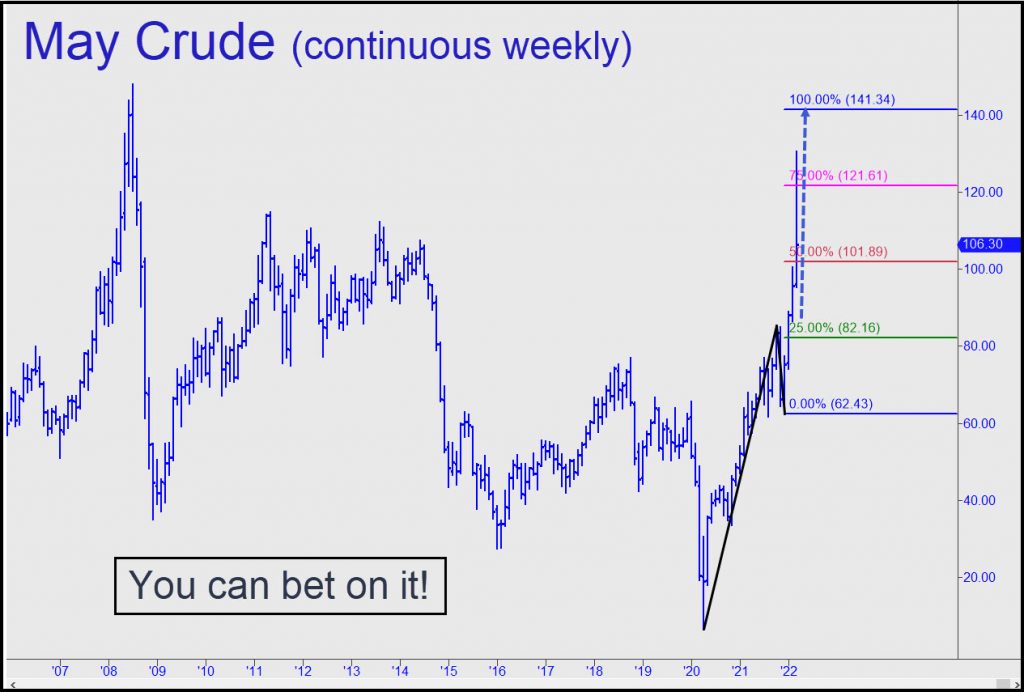

A Precise Forecast for the Coming Blowoff in Crude Oil

Considering the size of the crude-oil market and its geopolitical importance, the rally begun two years from $6.50/bbl amidst fears of a Covid-caused Depression ranks as one of the most spectacular and consequential in history. Consumers are coping at the moment with speculative excesses brought on by the curtailment of Russian petrofuels, and by disruptions, real or feared, in the global distribution network for energy. Pump prices have doubled since the pandemic began, piling crushing weight on a U.S. economy that was already close to buckling from steep increases in the cost of nearly everything. How much higher can prices go? The headlines suggest there is no relief in sight. But an end to the cost spiral is surely coming, since the parabolic rallies in many commodities, particularly oil, grains and metals, are too steep to sustain.

When the wilding spree ends and prices fall as precipitously as they have risen, the result will be a deflationary bust that will send the global economy into deepest recession or even Depression. Oil cannot but lead the way down, since its collapse will be exacerbated by the vast swath of the energy patch that has been hocked to financiers in order to propagate growth in derivatives markets that are much larger, even, than the oil sector. I referred to this effect as a ‘double whammy’ in my last commentary, which was titled Inflation’s Last Fling.

Here’s the Trade…

So where might crude’s rally reverse, popping an asset bubble that has been building for more more than three decades? The chart above makes a persuasive case for a bull-market top at $141. That would represent an 8% gain over this month’s so-far peak at 130.50, and a 33% gain over the current $106. The May contract shown may need to correct for a few weeks or longer before the blow-off rally can begin, but there can be little doubt that it will reach a minimum 141. Under the rules of the Hidden Pivot Method, this can be inferred from the ease with which buyers blew past the red line, a ‘midpoint resistance’ at 101 that is often useful, if not to say infallible, in determining trend strength. The chart also suggests that a pullback to the green line ($82) would offer an extraordinary opportunity for bulls to get aboard ‘mechanically’ for one last, spectacular ride.

Inflation’s Last Fling

Economists, particularly those who specialize in monetary theory, generally agree that inflation is an increase in the supply of dollars, and deflation a decrease. In practice, however, this theory is far too vague to be of any value for making predictions, since no one has a clue how much money is out there. There are so many fungible forms of it that even call options on Bolivian reverse floaters could probably be substituted for cash in a cleverly structured transaction. Further complicating the calculation of money in the system is that it can expand like heated gas if borrowers are confident that economic growth will remain strong. That is the underlying dynamic of money velocity, and when the level of confidence reaches a manic level of heedlessness, as is the case now, the money supply will expand commensurately.

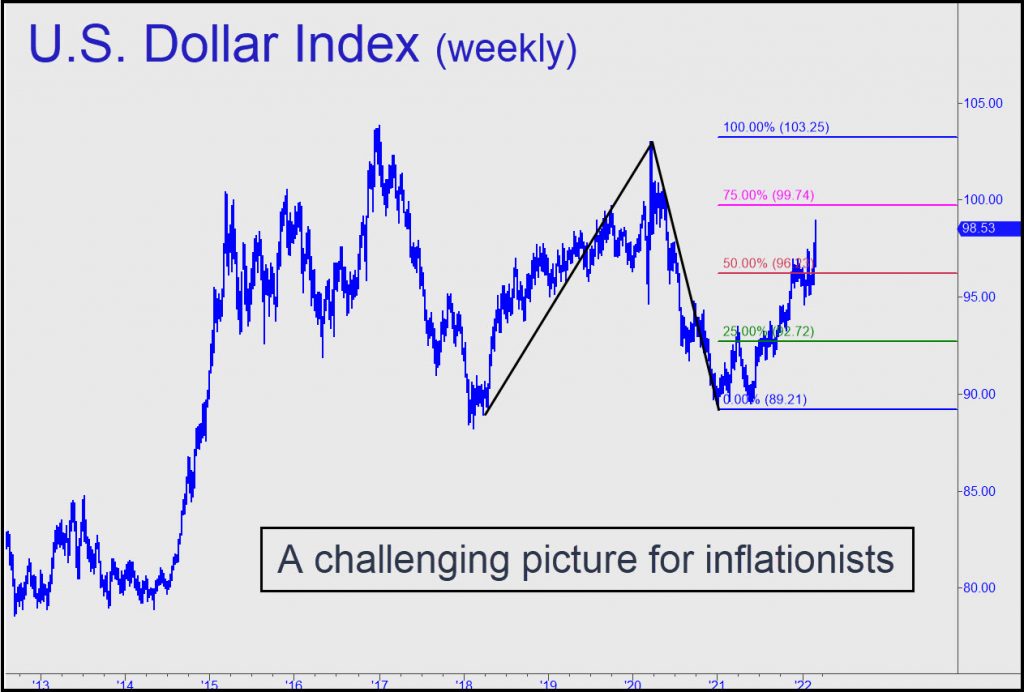

But what to make of the dollar chart above? The headlines reflect growing anxiety over inflation, since prices for just about everything are rising, led by crude oil quotes caught in a parabola that has gone out of control. Under the circumstances, shouldn’t the dollar be getting hammered? There is an easy explanation for this seeming paradox: Although the dollar in plain fact is fundamentally worthless crap, all the other currencies are even worse crap. Further widening the gap is the dollar’s singular usefulness in supporting a global casino with table action in derivatives markets alone exceeding $2 quadrillion. The dollar is the only currency remotely capable of handling such sums, and that’s why it is indispensable. Its relative buoyancy in the global currency toilet would not be much of a concern but for the fact that the vast preponderance of borrowing is denominated in dollars. This means debts will be harder to repay as the dollar continues to rise. It also implies that every nation that uses oil to generate power will find it increasingly unaffordable, since most oil purchases are in dollars. Consumers of crude will face a double whammy, actually, since the price of crude itself has been rising very sharply relative to all currencies and could be on its way to — who knows? — $200 a barrel.

A Double Whammy

Most economists will tell you that that would be highly inflationary. Indeed, the rise so far accounts statistically for much of the current inflation. However, at some level, perhaps even the current one of around $115, demand will begin to dry up, since consumers more and more will lack the means to pay for endless surcharges in the price of goods and services requiring energy inputs. There is a double-whammy here, too, since energy resources are the collateral backing much of the world’s sovereign debt. Imagine how quickly inflation could turn to deflation when the oil-price blowoff ends, as it must. When that happens, everyone on the lending side of each and every derivatives transaction should just kiss his money good-bye. Unfortunately for us all, this is not just imaginable, it is inevitable, since it will be an unavoidable effect of the coming bear market in U.S stocks.

In those circumstances, the only investable assets that won’t be collapsing will be the dollar and gold. The former will soar not because it is no longer crap, but because urgent demand from borrowers unable to roll loans will put it in a short-squeeze of epic dimensions. The eventual result will be a deflation that even the most doctrinaire monetarists will recognize and understand, since its chief symptom, a crushing increase in the real burden of debt, will be felt by anyone who owes dollars.

Enjoy inflation while it lasts, since what’s coming next will not be something to which we can simply resign ourselves with a shrug, like higher prices for gas, groceries and all the rest. Deflation will impose hardships far more difficult to avoid than merely curtailing spending on certain items. It will be bankruptcy writ large, a rebuke to excesses that have been accumulating in the financial system for more than 30 years.

Playing Ukraine Forward as a UFC Fight

Few expected Ukraine to put up such a fierce fight, least of all Vladimir Putin. Despite his overwhelming advantage of firepower and troops, he and the rest of the world might have known better, given the reputation Russian soldiers of all stripes earned in battle during the last century. Setting ethnic Russians against one another was bound to produce a bloody battle rather than an overnight victory such as Bush achieved shelling Baghdad. As a result, Putin has had to pull out all the stops with a veiled nuclear threat in order to show the world that he has the power to decide the war’s outcome if and when chooses.

However badly he wants to re-unite the republics under the flag of Mother Russia, fulfilling what he regards as the destiny of a once glorious and powerful USSR, Putin could never have been eager to have Russians spill each other’s blood in his quest to rewrite history. It has cost him a reported 4,300 troops already, with corresponding losses on the other side, significant physical damage to Ukraine’s physical infrastructure, and an enormous refugee crisis for the country’s civilian population.

Nukes? Yeah, Sure…

Putin reportedly has put nuclear forces on standby, but the possibility he will use them seems remote. Supposedly, the Russian leader is already considering talks with Ukrainian President Zelensky, even though casualties so far are just a small fraction of what they’d be if a nuclear device were to be used. Putin had seemed astute enough in the past to avoid making idle threats, especially grandiose ones, but in this instance he has shown himself to be no better at wielding a big stick than Biden.

In these weekly commentaries, I usually attempt to predict how U.S. markets will react to the significant geopolitical events of the day. Since no one other than perhaps Fox commentator Victor Davis Hansen is capable of hazarding a respectable guess about what the invasion will bring in its wake, we might expect U.S. stocks to open with somewhat more confusion than usual this evening. How will a CNN junkie, with a presumptive average IQ of 86, trade the news? That is the question you must answer if you want to get the jump on index futures as they start the new week. My guess is that shares will open at least moderately lower and grope their way to the usual, criminally rigged bottom sometime in the early dawn on Monday. The invasion of Ukraine is just a top-of-the-card UFC fight as far as the blithering morons who mainstream the news to a world equally clueless about how to react to it are concerned. My market advice is to take the odds and buy stocks on weakness.

Prepare for Deflation

______ UPDATE (Feb 28, 1:29 a.m. EST): I spent the evening with a woman whose well-informed take on current events has caused me to reconsider my remarks earlier this evening concerning the effects of Ukraine on the markets. From a geopolitical perspective, it would seem that the cause of peace can only benefit if the world succeeds in getting the schoolyard bully to back down. That’s assuming Putin hasn’t flipped his lid, as many seem to think, and goes for broke with more annexations in Eastern Europe. But a quite plausible alternative scenario suggests that Putin’s defeat would provide only a brief respite from events that could lead to global economic depression and a world war fought over oil.

The price of crude is up 6% tonight at $97 a barrel, underscoring the credibility of this threat. It has reminded us that however plentiful underground sources of crude oil and natural gas, disruptions in the distribution network could cause both to become scarce overnight. On top of scarcity, a steeply rising dollar will make energy even more expensive for every country other than the U.S. There is also a strong possibility that Russia, whose economy is based largely on energy resources, is headed into bankruptcy.

Choking off Demand

All of these factors are massively deflationary, and anyone who suggests otherwise — i.e., that rising oil prices and more supply chain shortages will cause inflation to steepen — is not thinking clearly. Although it’s true that higher oil prices will raise the cost of nearly everything, this will eventually choke off demand, bringing on deepest recession (a.k.a. Depression). That would cause financial assets that are hyperleveraged to energy resources to implode, deflating a $2 quadrillion derivatives edifice as well as paper assets that lie outside this market.

A given at this point is that U.S. stocks are in the early stages of what stands to be the worst bear market in history. That, too, would be powerfully deflationary, as would the collapse of home prices that have risen to absurd levels in the last year. Most deflationary of all, however, is the strengthening dollar, which is raising the real burden of debt for virtually everyone who owes them, including Uncle Sam. This is one more reason why I continue to hold fast to my prediction that the next move by the Fed will be to ease, rather than tighten.

Concerning my advice to buy stocks on weakness, I hereby recant it. The thieves who make their living manipulating stocks in the wee hours might succeed at exhausting sellers sufficiently to propagate a short squeeze on Monday, as suggested above. But the much larger force will be a bear market that began with the record high achieved on the first trading day of this year. The deflationary noose is about to tighten just as most pundits are ratcheting up their expectations for sharply higher prices for food, automobiles, energy and much else that we consume. With wages lagging badly and asset valuations about to deflate across-the-board, where will the money come from to feed the inflation that virtually every economist has been warning us is coming?

What’s Your Take?

[The markets will be closed on Monday for President’s Day, but I am putting out fresh touts and commentary because DaBoyz are required to briefly let the beast out of its cage on Sunday evening. Up-to-the-minute updates from Rick’s Picks will resume on the home page and in the trading rooms on Tuesday. RA ]

Technicians use charts to get a precise handle on trends and price reversals. However, even the unschooled eye can sometimes form a tradeable opinion by merely glancing at a chart. Does the one displayed above tell you anything that might be actionable? To my eye, and without resorting to any of the proprietary tricks that are possible with the Hidden Pivot Method, I see the Dow Industrials rolling over due to the presumptive weight of heavy supply. There are many reasons we could adduce for this; however, pondering ‘reasons’ would negate the value and usefulness of technical analysis, which shuns ‘reasons’ as mere noise in order to focus on how an infinitely complex conflation of ‘reasons’ are actually perceived and acted on by traders and investors.

The chart above does not make it possible to infer with confidence that a full-blown bear market is about to unfold. But there is still the visually intuitive sense that: 1) a major rally from these levels is unlikely; and, 2) a large drop is needed to form a base before spectacular new highs could conceivably be achieved. Again, using only the eyes rather than the brain, how far do you think the decline would have to go in order for a base to form? There is no correct answer, but my subjective eye ‘needs’ a selloff into the void between the pink and red lines. Respectively, the levels are a ‘secondary’ Hidden Pivot at 31,036 and a Hidden Pivot ‘midpoint’ at 26,762. If the Dow were to fall to the exact middle of that range, it would be at 28,899, a 16% drop from current levels. Drawing on my technical experience, I would say that that’s where the Indoos are headed at a minimum. Hidden Pivot voodoo can sharpen this outlook considerably, so stay tuned.

Let There Be Music!

For whatever reason, I’ve been streaming music at very high volumes lately, sometimes repeating tracks that I especially like 50-100 times. Here are links to two of my very favorites: the incomparable Chucho Valdes, playing one of the the most beautiful piano solos I’ve ever heard, Estás en Mi Corazón; and Mark Ford, who cuts loose in the middle of Gimme Some with a riff that will blow your mind if you’re a blues harp junkie like me.

Plenty of Scary News Signifying…Nothing?

Thinking back over the last 30 years, it’s hard to recall a single instance when traders ultimately lost money diving into stocks on ‘bad’ news. There was a hot mess of it on Friday, when shares plummeted to presumptive bargain levels on reports that Putin is about to invade Ukraine. That’s bad news indeed, although the talking heads seem as clueless as the rest of us about what it will ultimately mean. The end of NATO? Possibly. But even then we are left to wonder how NATO’s demise would change the global balance of power. And is Biden’s further mishandling of this crisis likely to doom his presidency? There’s no denying that he has ever looked stupider or more incompetent, and that’s saying something.

His first disastrous gaffe was to announce to the world that America’s reaction to an invasion would depend on the scale of it. In other words, if Putin invades only a little bit, the U.S. would stand down militarily. Biden’s handlers had already drummed up some very harsh economic sanctions a couple of weeks ago, but the jury is still out on whether the measures are so extreme that they will cause the collapse of the global banking system. We should have an answer in the fullness of time, but for now it couldn’t hurt to get a vegetable garden started in your back yard as spring approaches. Realize that the myriad shortages we are experiencing these days could seem relatively mild if shock waves from Ukraine prove unexpectedly destructive to worldwide trade.

Where Red and Blue Agree

Biden could have placed the blame for whatever happens in Germany’s lap by simply pointing out that the U.S. has no compelling reason to risk blood and treasure in Ukraine if Germany’s leaders can’t summon the gumption or moral courage to warn off Putin. Instead, Biden’s ‘wait-and-see’ speech maintained his track record for doing the wrong thing 100% of the time. To extend his losing streak, he is sending Kamala Harris to the Munich Security Conference, where the U.S. president normally speaks. Considering that the Vice-President’s lack of competence and judgment nearly matches that of her boss, this is like sending an attaché to Berlin just before Hitler invaded Belgium. In any event, virtually no one, not even CNN’s most insufferable Biden apologists, could conceive of the President going to Munich and impressing the world in this time of crisis with a display of statesmanship, wisdom and resolve. For in fact, foes on both sides of the red/blue political divide seem uncharacteristically united in fearing that he could only cause us embarrassment or worse.

Ironically, Biden’s mounting failures have stirred up a groundswell of resentment so broad and deep that it has rocked wokeness, cancel culture, the legacy news media and even Hollywood back on their heels. The fact that looney leftists continue to flail away at Dave Chappelle, Joe Rogan and Tucker Carlson only strengthens the impression not only that their socialist/fascist banner is going to get torched in November, but that they know it.

Stock Market Gets to Decide What Qualifies as a Catastrophe

Although headlines can move the markets, more often the opposite is true — i.e., the cyclically-ordained ups and downs of stocks tend to color our perceptions of the news. We are watching this dynamic unfold in real time as Russia prepares to trample Ukraine. Headline writers have done their best to gin up a seemly amount of dread, even if few understand Ukraine’s crucial significance to the balance of power in Europe. But if and when Russian tanks make their move, leave it to Wall Street bulls to shrug off a mere land war on foreign soil and then celebrate it with an exuberant surge. Even the pundits would be baffled into thinking investors somehow got it right — that Ukraine really doesn’t matter.

Unfortunately for us all, Kiev’s collapse could turn out to be just a warm-up for China’s impending invasion of Taiwan. Look for the stock market to grow more and more agitated in the months leading up to this increasingly likely event. Although it has been anticipated for years, it may have become inevitable with President Biden’s extraordinary lack of leadership. The only thing that could be preventing it from happening now is China’s expectation that the U.S. economy and political system are about to topple. Why put Chinese troops at risk, they may be asking themselves, when Mao’s dream of triumphing over America is so close to becoming a reality?

Energizing a Dying Bull

In the meantime, the stock market’s fright-mask feints, dives and swoons will be viewed by the herd as opportunities to scoop up ‘bargains’. If any event has the ability to revive a dying bull market, it is the brutal subjugation of Taiwan by our most powerful and threatening enemy. Again, a bull rally in the wake of such a disaster would confuse revelers into believing Taiwan ultimately doesn’t matter any more than Ukraine.

So what will finely wipe the idiot smile from U.S. stock speculators’ faces? Quite possibly Iran, which must be relishing the spectacle of American determination and stature crumbling under the leadership of the Ice-Cream-Licker-in-Chief. The mullahs are very close to having enough fissionable fuel for a bomb that would give them the means to settle some scores both ancient and new. This prospect should inspire more dread than a nominal subtraction from the number of countries with governments that allow certain freedoms. ‘Freedom’ has become a mere abstraction to half of America’s voters anyway, and it was never even remotely a concern on Wall Street.