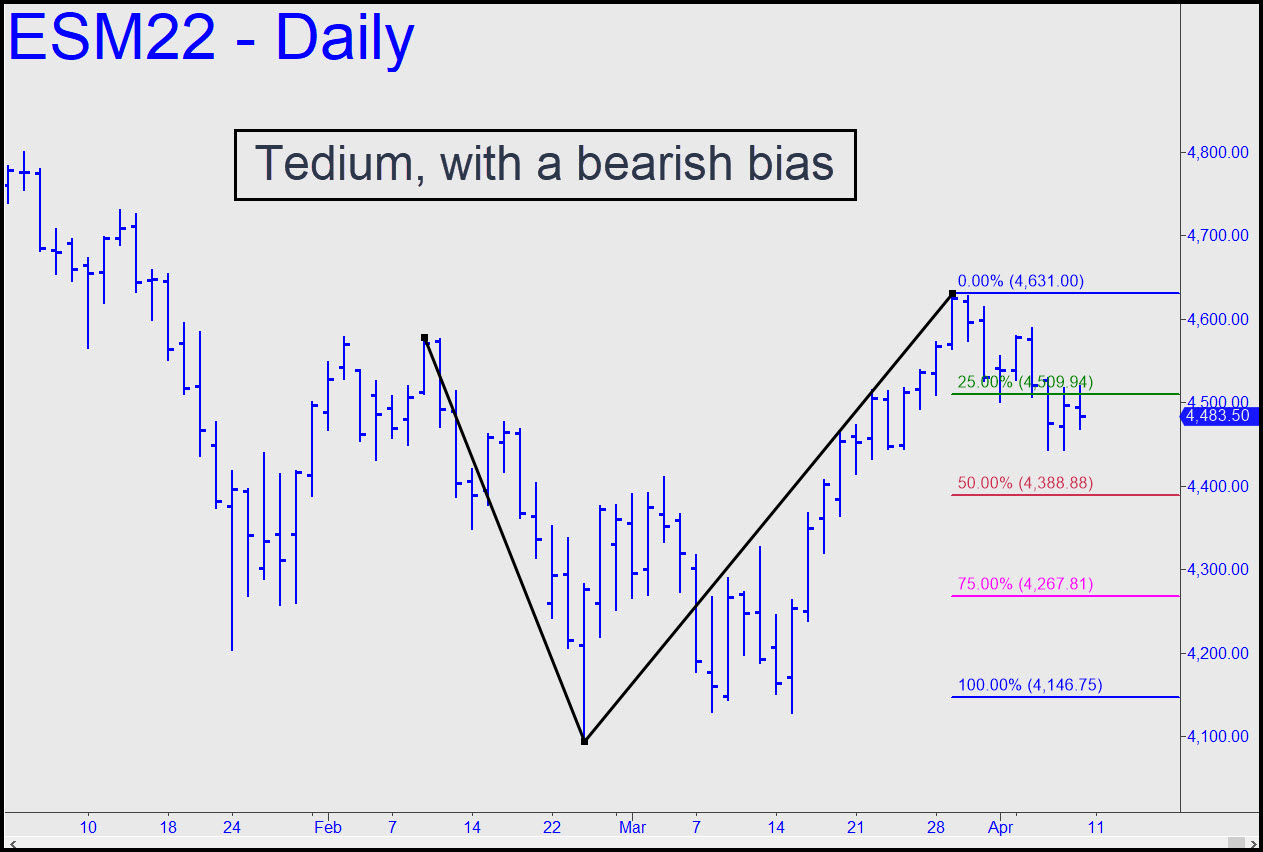

Did you get Mr. Market’s little joke last week? Although angst over the Fed’s plan to tighten until the cows come home stirred up a shitstorm of commentary and fearful headlines, the stock market acted like it was reliving a quiet week in 1955 under Eisenhower. For those who bet on volatility, it was like watching the croupier rake in all the red/green bets when zero has come up on a roulette wheel. The 4146.75 target shown remains my worst-case for now, and the pattern still looks serviceable for getting short on the way down. Don’t pass up an opportunity to bottom-fish at p=4388.88 in the usual way. Nudge me in the chat room and I may be able to help. I haven’t mentioned a scenario in which the futures rally to stop out C=4631 because the buying enthusiasm to get them there just doesn’t seem to be present at the moment. ______ UPDATE (Apr 12, 4:35 p.m.): The 4388 Hidden Pivot noted above nicely nailed the low of a 39-point rally that could have been worth as much as $16,000 to anyone who jumped on the opportunity as I’d advised. Alas, the trade triggered in the dead of night, as so many great opportunities do, so not many would have caught the move. The subsequent relapse to a new intraday low marked the rally as a sleazy distribution. It also reaffirmed that when a trade goes our way, we don’t want to be caught patting ourselves on the back as Mr. Market turns on us with a buzz saw. Here’s a chart that shows the stupid, gratuitous hump created by the day’s price action. Considering how bulls got sandbagged, look for more weakness on Wednesday.

Did you get Mr. Market’s little joke last week? Although angst over the Fed’s plan to tighten until the cows come home stirred up a shitstorm of commentary and fearful headlines, the stock market acted like it was reliving a quiet week in 1955 under Eisenhower. For those who bet on volatility, it was like watching the croupier rake in all the red/green bets when zero has come up on a roulette wheel. The 4146.75 target shown remains my worst-case for now, and the pattern still looks serviceable for getting short on the way down. Don’t pass up an opportunity to bottom-fish at p=4388.88 in the usual way. Nudge me in the chat room and I may be able to help. I haven’t mentioned a scenario in which the futures rally to stop out C=4631 because the buying enthusiasm to get them there just doesn’t seem to be present at the moment. ______ UPDATE (Apr 12, 4:35 p.m.): The 4388 Hidden Pivot noted above nicely nailed the low of a 39-point rally that could have been worth as much as $16,000 to anyone who jumped on the opportunity as I’d advised. Alas, the trade triggered in the dead of night, as so many great opportunities do, so not many would have caught the move. The subsequent relapse to a new intraday low marked the rally as a sleazy distribution. It also reaffirmed that when a trade goes our way, we don’t want to be caught patting ourselves on the back as Mr. Market turns on us with a buzz saw. Here’s a chart that shows the stupid, gratuitous hump created by the day’s price action. Considering how bulls got sandbagged, look for more weakness on Wednesday.

$ESM22 – June E-Mini S&Ps (Last:4397)

Posted on April 10, 2022, 5:20 pm EDT

Last Updated April 12, 2022, 4:35 pm EDT

0 comments

Posted on April 10, 2022, 5:20 pm EDT

Last Updated April 12, 2022, 4:35 pm EDT

0 comments